As we approach 2026, shifting trade policies and tariff volatility are casting a long shadow over retail supply chains — a trend Walmart and its peers are watching closely. According to recent estimates by S&P Global Market Intelligence, tariff‑related cost and supply‑chain disruptions have shaved nearly $907 billion from corporate profit forecasts so far in 2025.

At the same time, many retailers have delayed strategic investments as uncertainty becomes the “new normal.”

For Walmart — historically known for its low‑price leadership — this pressure is acute. The company has tied higher import duties directly to rising prices across general merchandise categories, and has cautioned that grocery inflation may spread further if tariffs persist.

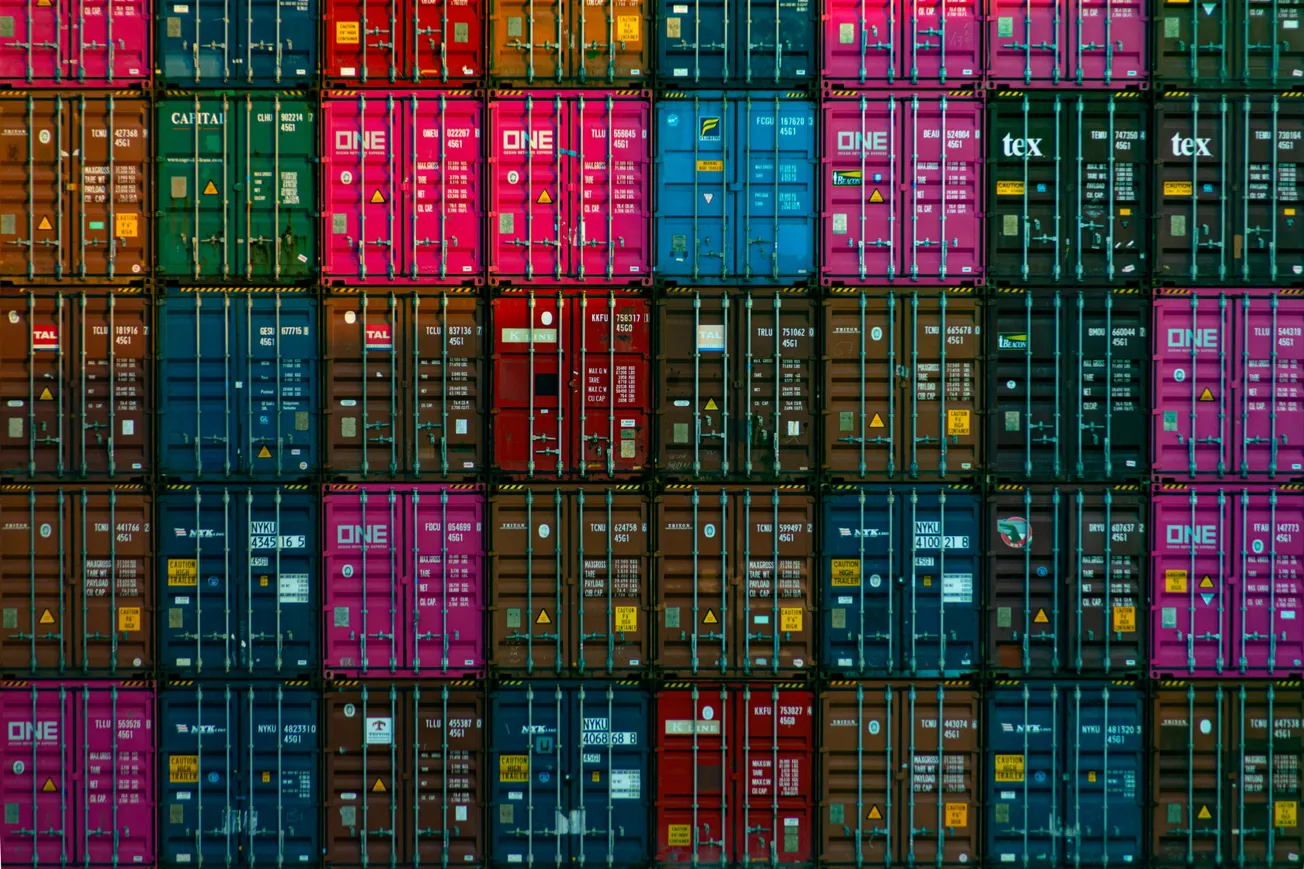

Structural Shifts: Retailers Re‑work Sourcing and Supply‑Chain Strategy

Retailers are responding by rethinking their sourcing and logistics strategies. Many are accelerating shifts away from high‑tariff geographies toward alternative sourcing regions or domestic production.

Others are doubling down on supply‑chain modernization: investing in automation, real‑time visibility tools and diversified supplier networks — a trend especially visible at Walmart.

Some analysts also believe 2026 may bring partial relief: lighter trade deals, tariff concessions tied to investment commitments, and renewed efforts at stable bilateral trade agreements could help stabilize the environment.

That said, the modern retail supply‑chain ecosystem now requires resilience, speed, and agility more than ever.

What It Means for Omnichannel Retail

For omnichannel retailers — especially those with heavy reliance on imports for discretionary goods — 2026 may be a make‑or‑break year. Expect:

- Pressure on margins and retail prices, particularly for goods exposed to high import tariffs.

- Continued supply‑chain reconfiguration, including more nearshoring or diversified sourcing.

- Accelerated investment in supply‑chain tech and visibility platforms, to mitigate volatility.

- More emphasis on private‑label goods and domestic sourcing to avoid tariff‑driven price swings.

For large retailers like Walmart, flexibility and procurement scale may help weather the storm. For smaller or less diversified players, maintaining affordability while guarding margins could be a steep uphill climb.