Omnichannel retail is no longer a buzzword but a vital retail strategy, blending physical and digital channels seamlessly. As retailers push for more integrated customer experiences, the demand for comprehensive omnichannel solutions has surged. In 2026, this sector has matured notably—with strong funding, prominent M&A activity, and rising innovation from startups worldwide.

This blog delves into the current state of the omnichannel retail solutions market, spotlighting top companies, funding patterns, geographic leadership, and acquisition trends. For investors, retailers, and innovators, these insights clarify where the sector is heading and highlight opportunities for growth and partnership.

Market Overview and Leading Companies

The omnichannel retail solutions landscape encompasses 288 companies globally, with 93 funded entities collectively raising $1.25 billion in venture capital and private equity. Notably, 51 companies have progressed beyond Series A funding stages.

Leading companies drive innovation with diverse offerings—from AI-powered retail sales management (BeatRoute) to cloud-based order management (Fluent Commerce) and comprehensive fulfillment platforms (NewStore). For instance:

- BeatRoute - AI-driven retail sales and distribution management platform based in India.

- Anchanto - Singapore developer of e-commerce and supply chain solutions.

- NewStore - U.S.-based omnichannel platform focusing on fulfillment and customer engagement.

Funding and Investment Trends

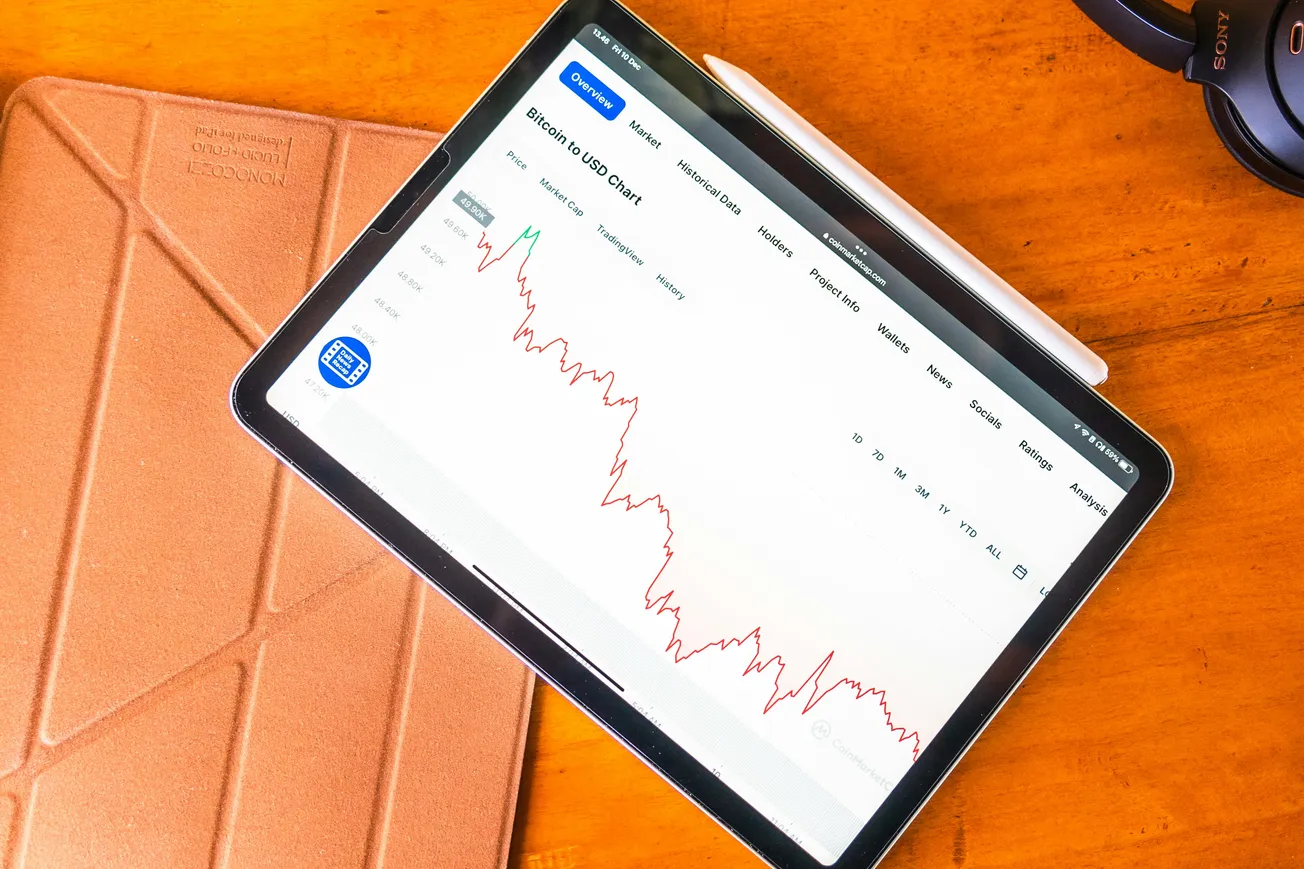

The sector witnessed its peak funding year in 2021, securing over $212 million. Although slightly lower in recent years, funding remained robust, with $82.5 million raised across six rounds in 2025—marking a 10.2% increase compared to 2024.

Breaking down funding by stage, early-stage rounds constitute the largest share at around $599 million, followed by late-stage funding of $275 million. Seed and post-IPO funding rounds represent smaller proportions.

Geographically, U.S.-based startups dominate investment flows, capturing close to $493 million over the past decade, well ahead of countries like Japan ($80M) and Colombia ($80M). The U.S. also leads in the number of companies (84), followed by India (39) and the UK (16).

M&A and Exit Landscape

The omnichannel segment demonstrates a vibrant exit environment, with 25 acquisitions and 3 IPOs to date—a nearly 10% exit rate notably exceeding that of the broader tech sector.

In 2024 alone, five acquisitions occurred, including Salesforce’s purchase of PredictSpring, a provider of store associate apps enhancing offline-to-online retail integration. Other recent acquisitions reflect strategic consolidation targeting back-end operations and digital storefront enhancements.

Talent and Institutional Influence

Top educational institutions have been instrumental in founding omnichannel startups, with Harvard Business School, IIT Bombay, and IIT Delhi alumni leading the way. Harvard graduates’ ventures have raised the most capital, reflecting both the innovation and investor confidence associated with these founders.

Strategic Implications and Future Outlook

Retailers and investors should note the ongoing shift towards integrated technology platforms that streamline end-to-end operations—from inventory management to customer engagement. Funding success in AI, fulfillment, and cloud order management signals where future competitive advantages will lie.

Additionally, a healthy pace of acquisitions suggests both maturity and consolidation potential in this space, advising early engagement for companies seeking to expand their omnichannel capabilities or acquire niche innovations.

Omnichannel retail solutions remain a dynamic and increasingly vital segment of retail technology, backed by sustained investment and robust company growth. As retail continues to evolve towards seamless consumer experiences, companies that innovate across platforms and logistics will succeed.

Stakeholders should monitor funding trajectories, key players, and emerging acquisition targets to successfully navigate 2026 and beyond.

More about investments: